Given the cross-industry heterogeneity in startup activity, it should not be a surprise that some regions see more startups than others. The importance of geography for economic activity does not seem to be going away, and startups are really important, so it's useful to look at state differences in new firm formation (I'll try to look at metropolitan areas later). As always, I define a startup as a new firm. Figure 1 shows startup rates by state, where the startup rate is the ratio of startups to total firms within a state (click for larger image).

Here I have taken the 10-year average, roughly peak-to-peak on the business cycle. As expected, there is a pretty wide variety ranging from DC at 3.5 percent to Nevada at 7.3 percent (for those who don't like seeing DC treated as a state, North Dakota is next-lowest at 3.8 percent). Next, Figure 2 shows state startup shares--startup firms by state as a percent of the national total (click for larger image).

|

| Figure 2 |

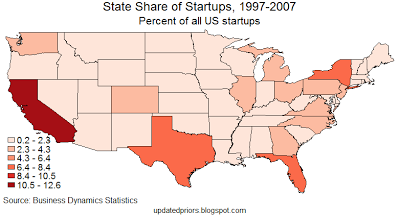

Again, I have used the 10-year average. Most states produce few startups. Figure 3 shows the top ten states (click for larger image):

|

| Figure 3 |

Note that the top ten states account for more than half of economywide startup formation, with California alone providing more than 12 percent. But this is a snapshot in time, and things are on the move. Figure 4 considers the change in state shares of national startup activity. Here I have used the difference between three-year averages (1987-89 and 2004-06), capturing the business cycle peak-to-peak change (click for larger image).

Florida has increased its share of national startup activity by nearly 2 percentage points, while California has slightly declined. The "rust belt" and the northeast have declined as well, with many western states and Texas gaining. I haven't looked at whether these trends held up through the Great Recession.

|

| Figure 4 |

Florida has increased its share of national startup activity by nearly 2 percentage points, while California has slightly declined. The "rust belt" and the northeast have declined as well, with many western states and Texas gaining. I haven't looked at whether these trends held up through the Great Recession.

Keeping in mind that geography can be tricky in the internet age, startup activity may be undergoing a major regional transition. It is likely driven in part by industry trends. Data can be noisy, and I have not here considered job creation quantities from startups, but these facts may be worth considering in the context of other discussions of geography and economics.